Scope 3 Category 2- Capital Goods encompasses all upstream emissions, extending from cradle to gate, arising from the production of capital goods acquired by a company within a reporting year. Unlike Category 1, which encapsulates a broader spectrum of purchased goods and services, Category 2 zooms in specifically on those items deemed as capital goods. These are not mere consumables but are defined by their extended life and pivotal role in a company's operations.

What are Capital Goods?

Capital goods, in the context of environmental accounting, are the final products that endure over an extended period, serving essential functions within a company. These may include equipment, machinery, buildings, facilities, and vehicles. In the realm of financial accounting, these assets are often classified as fixed assets or as part of plant, property, and equipment (PP&E).

Navigating Ambiguity

Distinction from Category 1:

Determining whether a purchased product falls under Category 1 or Category 2 can be ambiguous. To resolve this, companies are advised to follow their financial accounting procedures. Generally, capital goods are those that have a significant role in the manufacturing process, service provision, or the storage and delivery of merchandise.

Avoiding Double Counting:

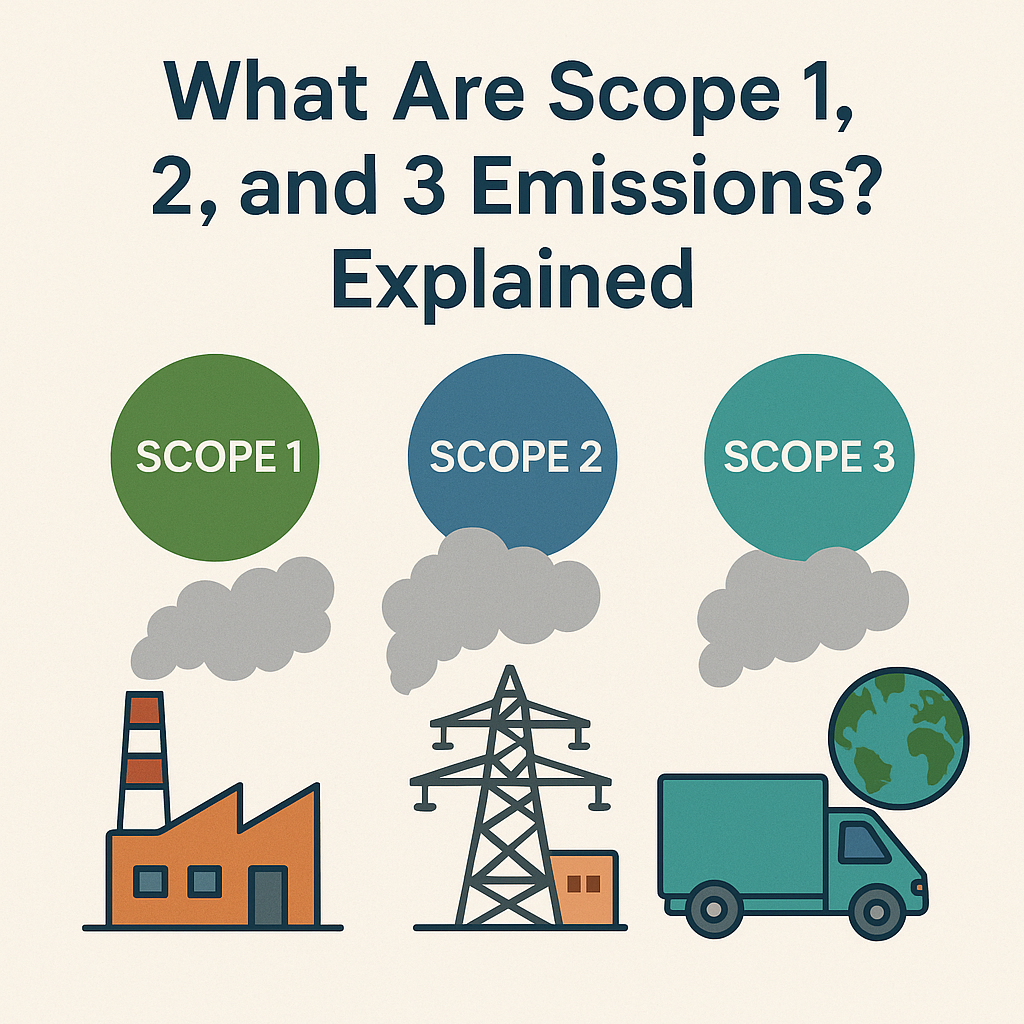

Companies must exercise caution to prevent double counting of emissions between Category 1 and Category 2. Emissions from the use of capital goods within a company's operations should be accounted for in either Scope 1 (e.g., for fuel use) or Scope 2 (e.g., for electricity use) rather than in Scope 3.

Unique Scope 3 Category 2: Capital Goods Accounting Considerations

Depreciation and Amortisation:

In financial accounting, capital goods are typically subjected to depreciation or amortisation over their lifespan. However, for the purpose of Scope 3 emissions accounting, companies are advised not to depreciate, discount, or amortise emissions from the production of capital goods over time. Instead, the total cradle-to-gate emissions should be accounted for in the year of acquisition, aligning with the methodology applied to other purchased products in Category 1.

Managing Fluctuations:

Given that major capital purchases may occur infrequently, Scope 3 emissions from capital goods might exhibit significant fluctuations from year to year. Companies are encouraged to provide contextual information in their public reports, highlighting exceptional or non-recurring capital investments.

Methods for Scope 3 Category 2: Capital Goods Emission Calculation

Companies have several methods at their disposal to calculate Scope 3 emissions from capital goods. These methods mirror those used for Category 1 (Purchased Goods and Services) and include:

- Supplier-Specific Method:

- Gathering detailed data on the greenhouse gas (GHG) emissions associated with a product, from its creation to its delivery point, directly from the entities that produce the goods.

- Hybrid Method:

- Combining supplier-specific activity data with secondary data to fill gaps.

- Collecting allocated Scope 1 and Scope 2 emissions from suppliers.

- Calculating upstream emissions by collecting available data on materials, fuel, electricity usage, transportation distance, and waste generation from goods production.

- Using secondary data where supplier-specific information is unavailable.

- Average-Product Method:

- Calculating the emissions by gathering information on the weight or appropriate units of purchased goods and then multiplying by the corresponding secondary emission factors.

- Average Spend-Based Method:

- Determining the emissions by gathering information on the monetary value of purchased goods and then multiplying by the corresponding secondary emission factors.

It's worth noting that the calculation methods for Category 1 and Category 2 align, providing consistency in emissions reporting.